SALE!

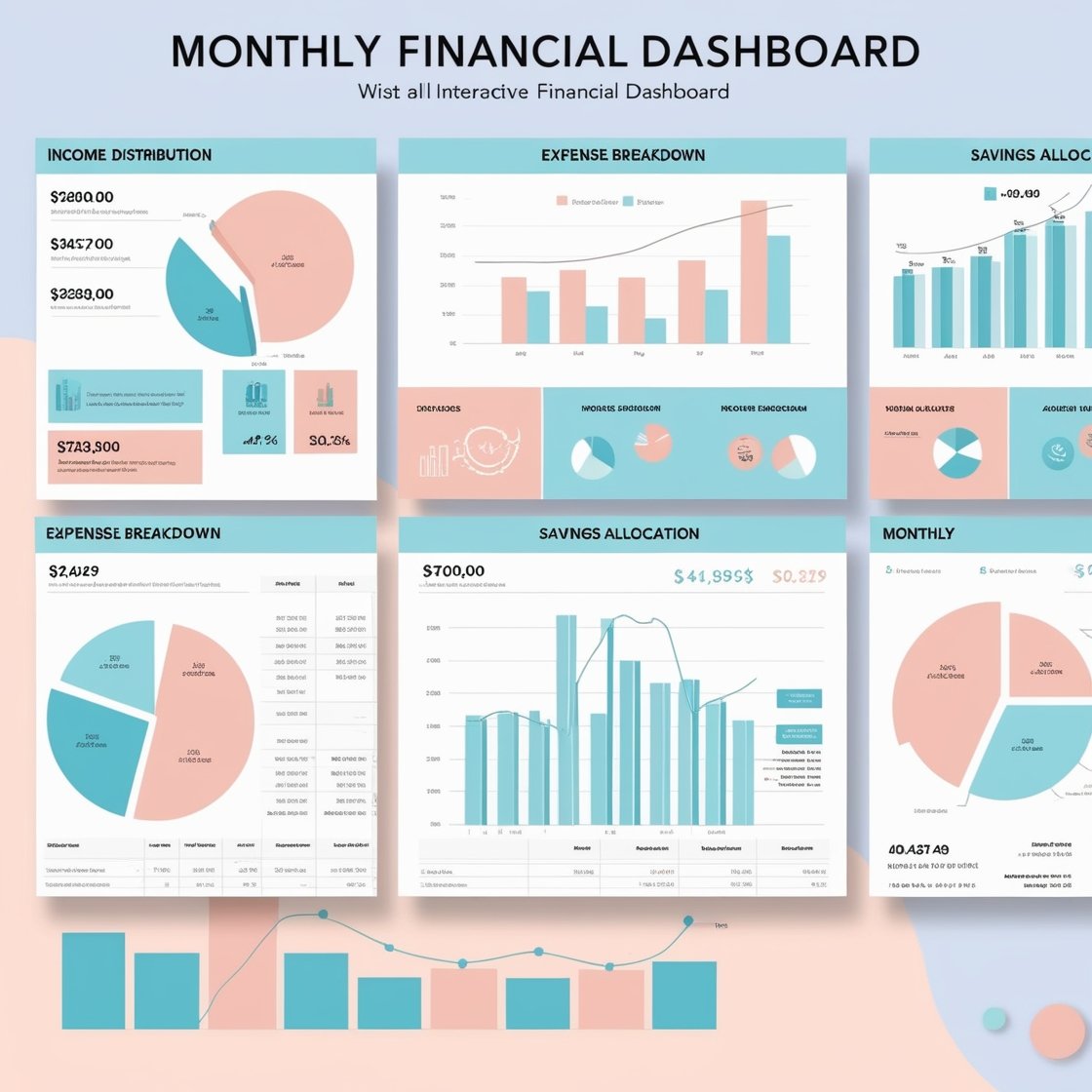

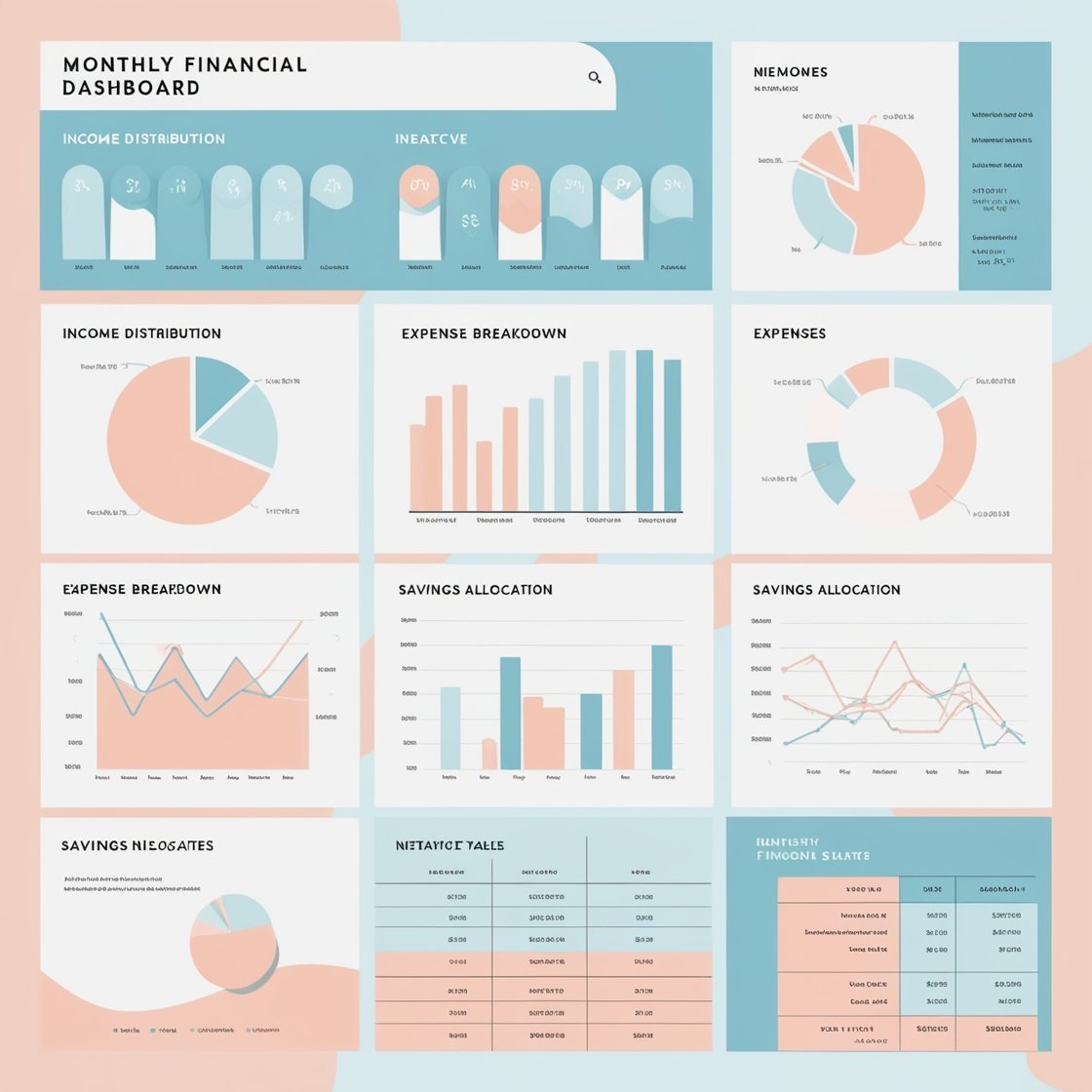

50/30/15/5 Budget Spreadsheet | Customizable Budget Tracker | Expense, Savings, & Debt Management Tool

Original price was: $30.$25Current price is: $25.

✔ Flexible Budget Ratios: Adjust percentages to fit your needs—use 50/30/15/5, 25/25/25/25, or your own custom ratios.

✔ Multi-Currency Support: Track your finances in any currency.

✔ Customizable Date Range: Plan your budget for any time frame.

✔ Automatic Calculations: Save time with pre-built formulas for easy tracking.

✔ Advanced Tracking Features: Monitor expenses, savings, debt repayment, and more!